idaho sales tax rate in 2015

State. You can print a 1025 sales tax table here.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Average form completion time.

. 98201 98203 98206 98207 and 98213. The state has reduced rates for sales of certain types of items. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales.

2020 Idaho Association of School Business Officials IASBO Spring Workshop. Educational Guide to Sales Tax in Idaho. 0 3 Some local jurisdictions do not impose a.

The 1025 sales tax rate in Chicago consists of 625 Illinois state sales tax 175 Cook County sales tax 125 Chicago tax and 1 Special tax. An alternative sales tax rate of 105 applies in the tax region Snohomish-Ptba which appertains to zip code 98204. 0 05 Some local jurisdictions do not impose a sales tax.

5 minutes to complete form. Taxidahogovindrate For years. Prescription Drugs are exempt from the Idaho sales tax.

State State Tax Rate Rank Avg. Texas Sales Tax Rate Tables. Statewide Certified Staff Salary Summary.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon. Local Tax Rate a Combined Rate Rank Max Local Tax Rate. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85.

You may need a Sales Tax Certificate if any of the following apply your business. The sales tax jurisdiction name is Chicago Metro Pier And Exposition Authority District which may refer to a local government division. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

The Everett Washington sales tax rate of 99 applies to the following five zip codes. Clothing has a higher tax rate when you spend over 175and a special local sales tax of 075 may apply to meals purchased in some localities. Imports for consumption are taxed at the same rate as the sales tax.

An alternative sales tax rate of 106 applies in the tax region Snohomish which appertains to zip code 98208. A special sales tax on alcoholic beverages was repealed in 2010. Business purchases for resale are also exempt with the use of a Sales Tax Resale Certificate Form ST-4 completed by the buyer.

Public School Finance at the Idaho State Department of Education prepares payments for districts and creates school district financial data reports.

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

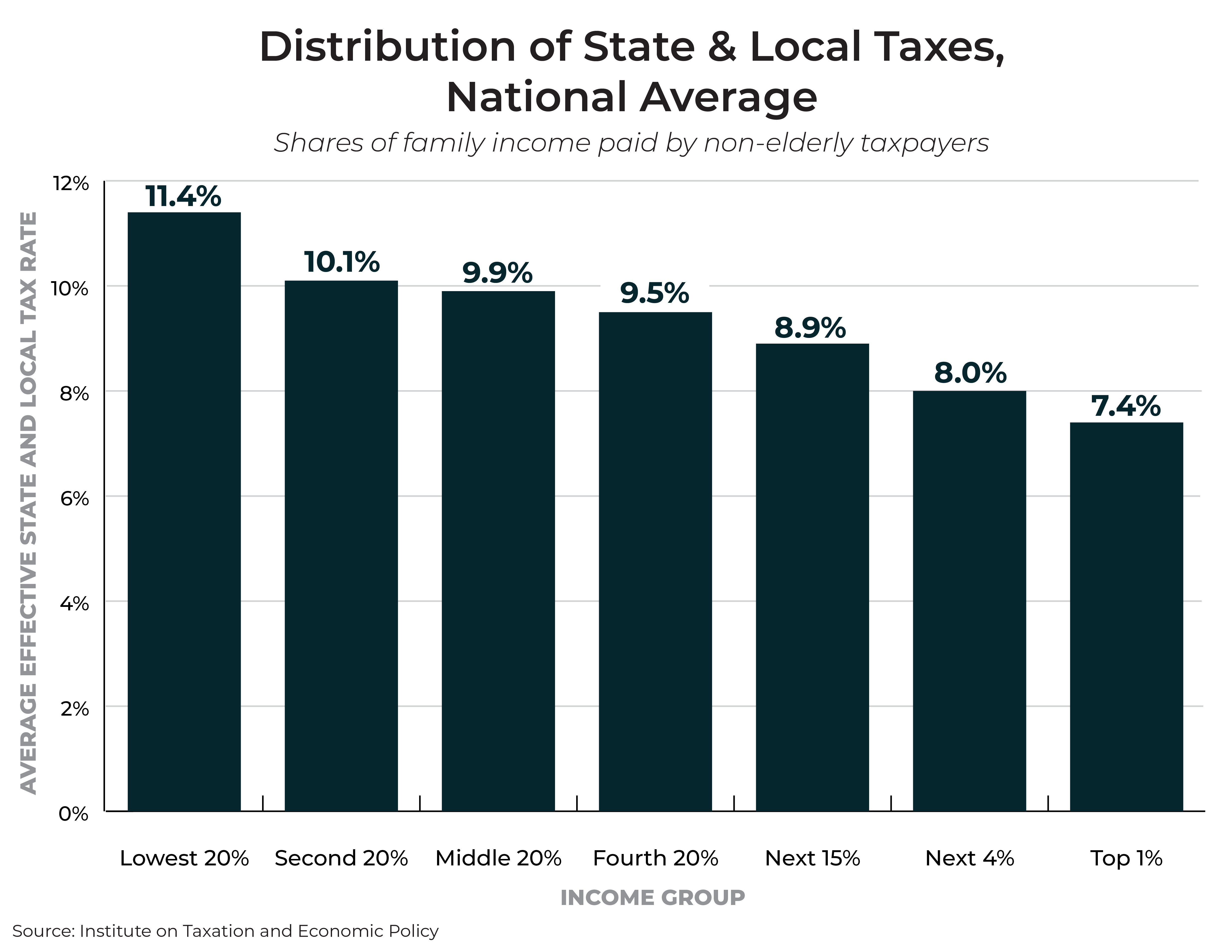

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

Sales Taxes In The United States Wikiwand

How To Register For A Sales Tax Permit Taxjar

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Sales Taxes In Your State Tax Foundation Of Hawaii

Historical Idaho Tax Policy Information Ballotpedia

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

How To Charge Your Customers The Correct Sales Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

Combined State And Local General Sales Tax Rates Download Table

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio